Outpatient surgeries like colonoscopies, cataract removals, and joint repairs are considered elective/shoppable services. The cost for these procedures can vary significantly across providers and settings (independent Ambulatory Surgical Centers (ASCs) or Hospital Outpatient Departments (HOPDs)). For employers and benefits managers, understanding this price variation is not only important but also a valuable cost-saving opportunity. By steering employees toward high-quality, lower-cost providers, employers can significantly reduce healthcare spending without compromising care.

Given the wide variation in pricing, it is essential to establish reference points for evaluating provider performance in terms of cost. In this blog, our primary focus is to explain how to identify cost variations in outpatient surgeries among providers by comparing them to Medicare reimbursement rates.

In this blog, we will cover:

- What is Medicare Benchmarking and Why It Matters ?

- Ambulatory Surgical Centers (ASCs) vs. Hospital Outpatient Departments (HOPDs)

- How to estimate Medicare reimbursement rates for commonly covered outpatient procedures ?

- Understanding with Example: Estimating Medicare reimbursement for Total Knee Anthroplasty

What is Medicare Benchmarking and Why It Matters ?

Medicare benchmarking refers to using Medicare reimbursement rates as a consistent reference point to evaluate the cost of healthcare services. Since Medicare rates are publicly available, standardized, and systematically updated, they provide a useful baseline for comparing what different payers—such as private insurers or self-funded employers—are paying for the same services.

Whether you’re a patient, benefit advisor or a self-insured employer, benchmarking matters because it:

- Reveals Cost Variation: The same outpatient procedure can cost $2,000 at one surgical center and $5,000 at other surgical center.

- Supports Smarter Decisions: Self-insured employers use Medicare as a benchmark to negotiate contracts, build provider networks, and redirect care to high-value settings.

- Empowers Patients: When patients know the benchmark price, they can make more informed, cost-effective choices—especially when they have coinsurance or high-deductible plans.

Ambulatory Surgical Centers (ASCs) vs. Hospital Outpatient Departments (HOPDs)

- Ambulatory Surgical Centers (ASCs): These are independent, often physician-owned facilities that focus exclusively on outpatient procedures. They are known for high throughput, operational efficiency, and lower cost. For example, Renovo Health.

- Hospital Outpatient Departments (HOPDs): These are outpatient departments within traditional hospitals. Most hospitals have outpatient department.

How to Estimate Medicare Reimbursement Rates for Covered Outpatient Procedures ?

For estimating medicare reimbursement, we need to calculate two components: Physician Fee and Facility Fee.

Calculating Physician Fee: To estimate the physician fee, we need to use Physician Fee Schedule (PFS) Relative Value Files (here). These files are being updated quarterly.

When Medicare reimburses physicians for services provided in non-facility settings (such as physician offices), it uses the non-facility pricing formula. In contrast, when services are provided in a facility setting (such as a hospital or ambulatory surgical center), Medicare applies the facility pricing formula. Typically, the non-facility payment is higher than the facility payment because it includes the physician’s overhead costs—such as office space, staff, and equipment. In facility settings, these overhead costs are billed separately by the facility, and the physician is reimbursed only for the professional component of the service.

The formulas below reflect how the maximum allowable national physician fee is derived for both settings (Facility and Non-facility):

Physician Fee (Facility)=Facility RVU×Conversion Factor

Physician Fee (Non-Facility)=Non-Facility RVU×Conversion Factor

The total RVU in both cases is the sum of:

- Work RVU

- Practice Expense (PE) RVU (either Facility or Non-Facility)

- Malpractice (MP) RVU

In the PPRRVUxx_XXX.xlsx file (located in the RVU folder of the Medicare Physician Fee Schedule), the total Facility RVU and Non-Facility RVU are provided in Columns L and M, respectively.

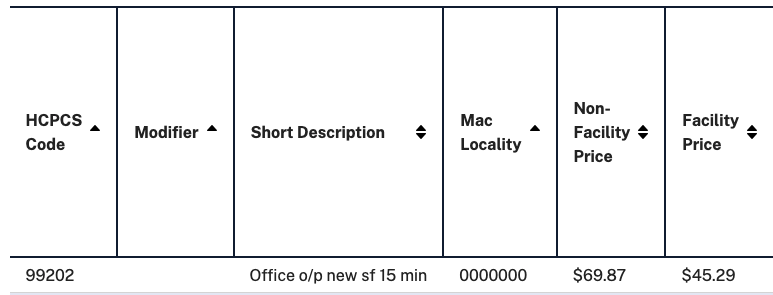

Let’s consider CPT 99202, which represents a new patient office visit lasting less than 15 minutes. For the year 2025 (PPRRVU25_JAN.xlsx), the Medicare Physician Fee Schedule provides the following values:

- Conversion Factor: $32.3465 (as listed in Column Y of the RVU file)

- Total RVU (Facility Setting): 1.40

- Total RVU (Non-Facility Setting): 2.16

Hence, the CMS national average reimbursement for both settings is:

Physician Fee (Facility)= 1.40*32.3465 = $45.29

Physician Fee (Non-Facility)= 2.16*32.3465 = $69.87

You can verify these numbers here in the lookup tool.

Please note that the final payment amounts are adjusted based on geographic location using GPCI (Geographic Practice Cost Index) factors. The formula for calculating location-adjusted rates is detailed in the RVUYYX.pdf file, located within the RVU folder of PFS.

Now, let’s discuss how to calculate the facility fee. This fee is calculated differently depending on the setting—ASCs or HOPDs. In both cases, the reimbursement is determined by multiplying a payment weight by a conversion factor.

The good news is that CMS publishes the national average payment rates for both ASC and HOPD settings for all covered outpatient procedures. You can find these values in the files here [1]:

- ASC Facility Rates: XXXX NFRM Addendum AA, BB, DD1, DD2, EE, and FF (Check Addendum AA, Column H)

- HOPD Facility Rates: XXXX NFRM OPPS Relative Weights without C-APC Methodology for ASC Ratesetting (Column D)

These rates represent national averages. To estimate location-adjusted payments, Medicare applies a wage index adjustment that reflects regional labor cost differences. The formulas are as follows:

Geographically Adjusted HOPD Payment = National Average*[0.6*Wage Index + 0.4]

Geographically Adjusted ASC Payment = National Average*[0.5*Wage Index + 0.5]

For ASC, the labor related portion of the payment rate is 50 percent and the remaining non-labor related portion is 50 percent [1]. For HOPD, the labor related portion is 60 percent and non-labor related portion is 40% [3].

Understanding with Example: Estimating Medicare reimbursement for Total Knee Anthroplasty

Let us calculate the Medicare reimbursement for total knee arthroplasty (CPT 27447) based on January 2025 files (PPRRVU25_JAN.xlsx – Column L).

The total facility RVU for CPT 27447 is 38.88.

Physician Fee (Facility) = 38.88*32.3465 = $1,257 (national average)

Now, let us calculate facility fee for both ASC and HOPD.

Hence, the total reimbursement for a Total Knee Replacement is $10,512 for an ASC and $13,613 for an HOPD. It is interesting to note that for the same service, CMS reimburses approximately 30% more to hospital-owned surgical centers than to independent surgical centers.

Medicare reimbursement rates vary by geographic location. To support benchmarking efforts, we’ve built a comprehensive database of Medicare rates across all regions. If you’re a TPA, benefits manager, employer, or consultant seeking to analyze or benchmark existing claims data, feel free to reach out to us at info@carecadet.com.

Reference

[1] https://www.cms.gov/medicare/payment/prospective-payment-systems/ambulatory-surgical-center-asc/asc-regulations-and-notices/cms-1809-fc (Accessed on: Jun 20, 2025)

[2] Medicare Claims Processing Manual. https://www.cms.gov/regulations-and-guidance/guidance/manuals/downloads/clm104c14.pdf (Accessed on: Jun 20, 2025)

[3] Outpatient Hospital Services Payment System. https://www.medpac.gov/wp-content/uploads/2022/10/MedPAC_Payment_Basics_22_OPD_FINAL_SEC_v3.pdf (Accessed on: Jun 20, 2025)